option to tax form

What are w2 Box 12 codes. VAT1614C - revoking an option to tax within 6 month cooling off period Use form VAT1614C for revoking an option to tax land or buildings within 6-month cooling off period.

Old Vs New Tax Regime For Salaried Business Taxpayers Eztax In Business Tax Tax Filing Taxes

March 1 2022.

. Nonresident Alien Income Tax. You can opt to tax one property at a time or all of the properties you own its your choice. These include people filing corrections to the Form 1040-NR US.

For example you need a VAT 1614A in a different situation to a VAT 1614D. Follow the step-by-step instructions below to design youre vat 5l form. For example puts or calls on individual stocks.

10 June 2022 Form Revoke an option to. Send the completed form and supporting documents to the. Quickly Prepare and File Your 2021 Tax Return.

Form vat1614a209 form for notification of an option to tax opting to tax land and buildings on the go. A typed drawn or uploaded. There are three variants.

HM Revenue Customs Option to Tax National Unit Cotton House 7 Cochrane Street Glasgow G1 1GY Phone 0141 285 4174 4175 Fax 0141 285 4423 4454 Unless you are registering for VAT and also want to opt to tax. However when you exercise a non-statutory stock option NSO youre liable for ordinary income tax on the difference between the price you paid for the stock and. For tax purposes options can be classified into three main categories.

Send this form to. These are generally options contracts given to employees as a form of compensation. For example incentive stock options.

When you exercise an incentive stock option ISO there are generally no tax consequences although you will have to use Form 6251 to determine if you owe any Alternative Minimum Tax AMT. To get started on the form use the Fill camp. Certificate to disapply the option to.

The IRS applies different rules depending on whether it is a call or a put to determine how the premium is treated. This notice has been updated to provide information on who is an authorised signatory for the purposes of notifying an option to tax the details can be found in a new paragraph 76. In this case please send both forms to the appropriate VAT Registration Unit VRU.

Where do I send this form. From Simple to Advanced Income Taxes. Refer to Publication 525 for specific details on the type of stock option as well as rules for when income is reported and how income is reported for income tax purposes.

Call HMRC for help on opting to tax land or buildings for VAT purposes. Opting to tax is quite easy. Restaurants In Matthews Nc That Deliver.

Income Tax Rate Indonesia. When you exercise an ISO your employer issues Form 3921Exercise of an Incentive Stock Option Plan under Section 422b which provides the information needed for tax-reporting purposes. Instead the options premium is either added or subtracted to the overall cost basis of the stock.

Report options-related transactions on Internal Revenue Service Form 8949 and Form 1040 Schedule D along with your other investment transactions. Sign Online button or tick the preview image of the form. Form Disapply the option to tax land sold to housing associations.

When you exercise an incentive stock option iso there are generally no tax consequences although you will have to use form 6251 to determine if you owe any alternative minimum tax amt. Ad Access IRS Tax Forms. Option To Tax Form.

The advanced tools of the editor will guide you through. Over 50 Million Tax Returns Filed. When an option is exercised the trader does not report the position on Schedule D Form 8949.

Complete Edit or Print Tax Forms Instantly. The following is a summary of various forms of stock option exchange programs and the associated issues that companies should consider in determining whether such a program is appropriate. Use form VAT1614C for revoking an option to tax land or buildings within 6-month cooling off period.

Opry Mills Breakfast Restaurants. Delivery Spanish Fork Restaurants. 10 hours agoThe Internal Revenue Service announced today that more forms can now be amended electronically.

Incentive Stock Option - After exercising an ISO you should receive from your employer a Form 3921 Exercise of an Incentive Stock Option Under Section 422b. I tend to remember option to tax forms by their numbers and letters. Soldier For Life Fort Campbell.

Form Revoke an option to tax for VAT purposes within the first 6 months. Ad IRS-Approved E-File Provider. 8 October 2014 Form Apply for permission to opt to tax land or buildings.

You do not need to do any tax reporting on the option premium until the contract is exercised sold or expires. The timing of submission is important. Select the document you want to sign and click Upload.

2 days agoGopal Rai was speaking after holding a round-table conference at Thyagaraj Stadium on Sunday to discuss the feasibility and cost of alternatives to single-use plastic SUP items. Chamber of Commerce have expressed concern about the ramifications of. Form for Notification of an option to tax Opting to tax land and buildings on the web.

Decide on what kind of signature to create. The tax forms have been included as an example for taxpayers. BANK All valid sales and use tax filers with account in an active status can use this system and there is no registration.

Request for Taxpayer Identification Number TIN and Certification Form 4506-T. Electronic Payment Options for Quarter-Monthly Weekly Sales Tax Filers Form 2414S Revised 12-2017 Option 1. Follow the step-by-step instructions below to design youre vat 5l form.

You complete form VAT 1614A there are other forms in the series but this is the main one you need to worry about and send it to HMRC. Blue Summit Supplies Tax Forms 1099 Misc 4 Part Tax Forms Bundle With Software And Self Seal Envelop In 2021 Tax. The relevant form to send to HMRCs Option to Tax Unit in Glasgow is VAT1614A which means that the landlord does not need HMRCs permission to opt because he has not made any previous exempt supplies in relation to the building see below re.

Essex Ct Pizza Restaurants. The W-2 box 12 codes are. Options contracts on equities that can be traded on the open market.

Income Tax Return Update Financepost In 2021 Finance Blog Finance Income Tax Return

What Are Your Options When It Comes To Filing Your Singapore Company Tax Returns Understand The Difference Between The Two O Tax Return Singapore Filing Taxes

Tax Due Dates Stock Exchange Due Date Tax

You Can File Your Tax Return On Your Own It S Easy Quick And Free When You File With Tax2win On Your Onenote Template Income Tax Preparation Tax Preparation

Are You A Small Business Small Business Inspiration Business Small Business

Blue Summit Supplies Tax Forms 1099 Misc 5 Part Tax Forms Kit 100 Count Security Envelopes Small Business Accounting Software Business Accounting Software

K9 Tax Form Taxes Humor Income Tax Humor Income Tax

Tx302 Payroll Withholding Tax Essentials Payroll Taxes Payroll Medical Insurance

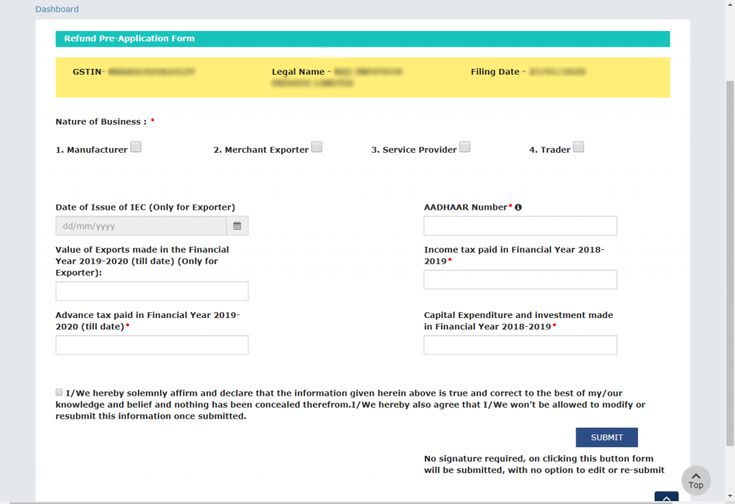

Gst Portal New Feature On Pre Fill An Application Form For Refund Tax Refund Application Form Filing Taxes

Checklist For Acquisitions 3 Real Estate Forms Writing A Book Review Lettering

1040 Form For Your Dog Taxes Humor Income Tax Humor Income Tax

Blue Summit Supplies Tax Forms 1099 Misc 5 Part Tax Forms Kit 100 Count Security Envelopes Business Accounting Software Tax Forms

Philadelphia Taxes Filing Taxes Tax Forms Tax Advisor

Invest In Nps Investing Digital India How To Plan

Pin By Olivia Reyes On Pta Donation Letter Pto Fundraiser School Pto

Form C S Is An Abridged 3 Page Income Tax Returns Form For Eligible Small Companies To Report Their I Business Infographic Singapore Business Income Tax Return

Where Are My Tax Forms Due Dates For Forms W 2 1099 1098 More Tax Forms Irs Tax Forms Student Loan Interest